Seriously Joe, Cancel All Student Debt

Here are the receipts legacy media isn't reporting on what cancelling student debt will do for our country

Yesterday I wrote about five key actions Biden can take to protect Americans and slow MAGA fascism. What if there was one single action that could help our economy, while positively affecting the racial wealth and income inequality gaps, grow healthy families, grow local businesses, decrease depression and suicide rates, and increase car and home ownership?

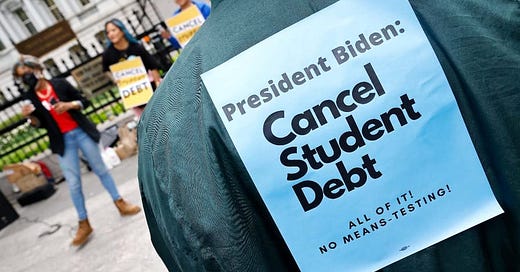

In fact, there is — cancel student loan debt. Joe Biden should use his Executive powers to cancel all student debt. Biden tried to go through Congress for a bill to cancel all student debt, reform the higher education loan system and make four-year public college free to all Americans. Given that Congress failed to act, Biden should act now to cancel student debt with an Executive Order. Let’s Address This.

Can Biden Cancel Student Debt?

In a word, yes. Notwithstanding that “more than 230 organizations and non-profits, including Americans for Financial Reform, the NAACP and the National Consumer Law Center called on Biden to cancel student loans on his first day as president,” Senator Elizabeth Warren published a detailed analysis by Harvard Law scholars affirming that the President has the authority to cancel student debt under the Department of Education. And especially given Trump’s plan to abolish the DOE, which will no doubt raise education costs, Biden needs to act immediately while he still can to protect American students.

Moreover, Biden has already used his Executive Order powers to cancel $175 billion in student debt. The question really isn’t about whether he has the power, it’s why won’t he use it? Even Senate Majority Leader Chuck Schumer, D-N.Y. said he supports forgiving the first $50,000 in loans. A poll from Vox and Data for Progress found that a majority of respondents support canceling some amount of debt.

How Will We Pay For It?

One criticism is the perennial “but how will we pay for it?” But as The Debt Collective points out:

Student debt cancelation doesn't require that any money be drawn from the Treasury. Your taxes aren't "going up" because of student debt relief. The money has already gone out the door. Canceling debt that has existed for 10, 20 and 50+ years is simply not requiring money to be paid back that was NEVER going to be repaid anyway.

Moreover, our nation does not suffer from a lack of resources; we suffer from an excess of greed. As I have said before, we “cancel” the debts of hundreds of millionaires and billionaires every year through tax breaks. We’ve bailed out billionaire corporations repeatedly without batting an eye. The theory here is that bailing out these corporations is necessary for a healthy economy and sustainable workforce. But isn’t it time the American people received that same benefit to overcome a system many feel is rigged against them?

President Donald Trump’s tax cuts failed to improve our economy, said Maya MacGuineas, president of the Committee for a Responsible Federal Budget. On the other hand, plenty of economists believe that canceling student loan debt for around 40 million Americans would most likely boost our economy.

Isn’t Cancelling Student Debt Unfair?

Another criticism is that canceling student debt is unfair to those who have already managed to pay off their loans. It’s interesting how this argument is never applied to those who had their PPP loans forgiven. But the reality is, canceling student debt benefits everyone, not just those with debt. As the progressive nonprofit Americans for Financial Reform reported, “A study by the Levy Institute showed that student debt cancellation would boost GDP by as much as $108 billion per year, and add up to 1.5 million jobs per year.”

Just as important, surviving a past injustice does not mean we should prevent future justice. It means we should accelerate it.

Far from being “unfair,” canceling student debt would also deal a blow to the massive and increasing racial wealth gap. Studies repeatedly show that Black students are burdened with greater student debt as compared to white students because of the lasting impact of policies like redlining and Jim Crow. Compounding this injustice, the Black-white disparity in student loans increases after graduation. This growing divide is generational and further separates the haves from the have nots.

Likewise, studies and polling show that because of student debt, women are putting off having children, and young people in general are putting off buying homes and cars, or starting small businesses. National Association of Realtors chief economist Lawrence Yun told NPR that “student debt has people delaying homeownership by five to seven years,” and estimates that broad loan forgiveness would increase home sales.

One study of 829 people by a student loan debt planning company even found that high loans can increase depression, anxiety and even suicidal thoughts.

This suffering is preventable. Biden can mitigate it with the swipe of a pen.

Cancelling Student Debt Is The First Critical Step

Obviously, the system needs more than a quick reset. The federal government must ensure that student loans are grounded in reality and in job opportunities after graduation. Debt reform means interest rates should also be capped. But we have to start with meaningful debt relief that will give millions of Americans room to breathe.

And as I’ve written before, some may argue that Trump would likely try to roll this back. But if so, let’s force him to make that choice publicly. Imagine Trump explaining to the 40 million Americans shackled by $1.7 trillion in exploitative debt that he plans to reinstate that burden while simultaneously cancelling $2 trillion in taxes for the wealthiest Americans?

Young people were raised on the belief that education is the passport to the future. They pursued higher education with the understanding that economic security is the natural result of higher education. The federal government, which was elected by students and their parents, is supposed to prevent the exploitation of vulnerable young people. Instead, tuition at four-year private colleges has increased 25 percent since the 2008-09 school year and closer to 30 percent for public colleges. Meanwhile, average salaries have not increased by the same margin — not at all.

In Conclusion

College should enable the American dream. Instead, for many, it undermines it. It shouldn’t seem radical for a young person to want the same economic access afforded to their parents and grandparents. It’s no coincidence, then, that millennials are financially worse off than their parents — a first in American history.

In 1968, the year Biden graduated from law school, the median cost of public college was $329 and the median salary was about $10,000 — a 1:30 ratio. Today, the median cost of public college is $10,230 and the median salary is about $51,000 — a 1:5 ratio. As Biden leaves office for the final time, canceling student debt is a (relatively) easy but key reform. The price tag only seems high when we don’t put it into perspective. In reality, the American people cannot afford for Biden to not cancel student debt.

A version of this OpEd appeared on NBC Think.

I’m trying my best to give Joe Biden and Kamala Harris the benefit of the doubt. Trump is broadcasting his agenda. He means business. But Joe’s slow roll has echoes of Merrick Garland’s inaction. The time to move is now!

He has Presidential immunity he can and should defy the Supreme Court as they have made their position invalid. He must do some amazing things for the American people out the door. He should also write a Trump proof executive order giving back the rights to women to chose their own medical care and protect the rights of every American even those born to immigrants who are American citizens.